US Annual Cropland- High Returns Remain Steady Through Q3 2022 When Will it Revert to Average?

By Matt Harrod, Director of Research and Analysis

US farmland values have been on a tear for the last year and half, increasing at rates not seen since 2011 – 2012, when drought and short supplies drove agricultural commodity prices to new highs. The current run up in prices has numerous drivers, including drought last year in the EU and China, drought in the US and China this year, war in Ukraine disrupting grain shipments in the Black Sea, and, not least, monetary inflation hitting numbers not seen since the early 1980’s.

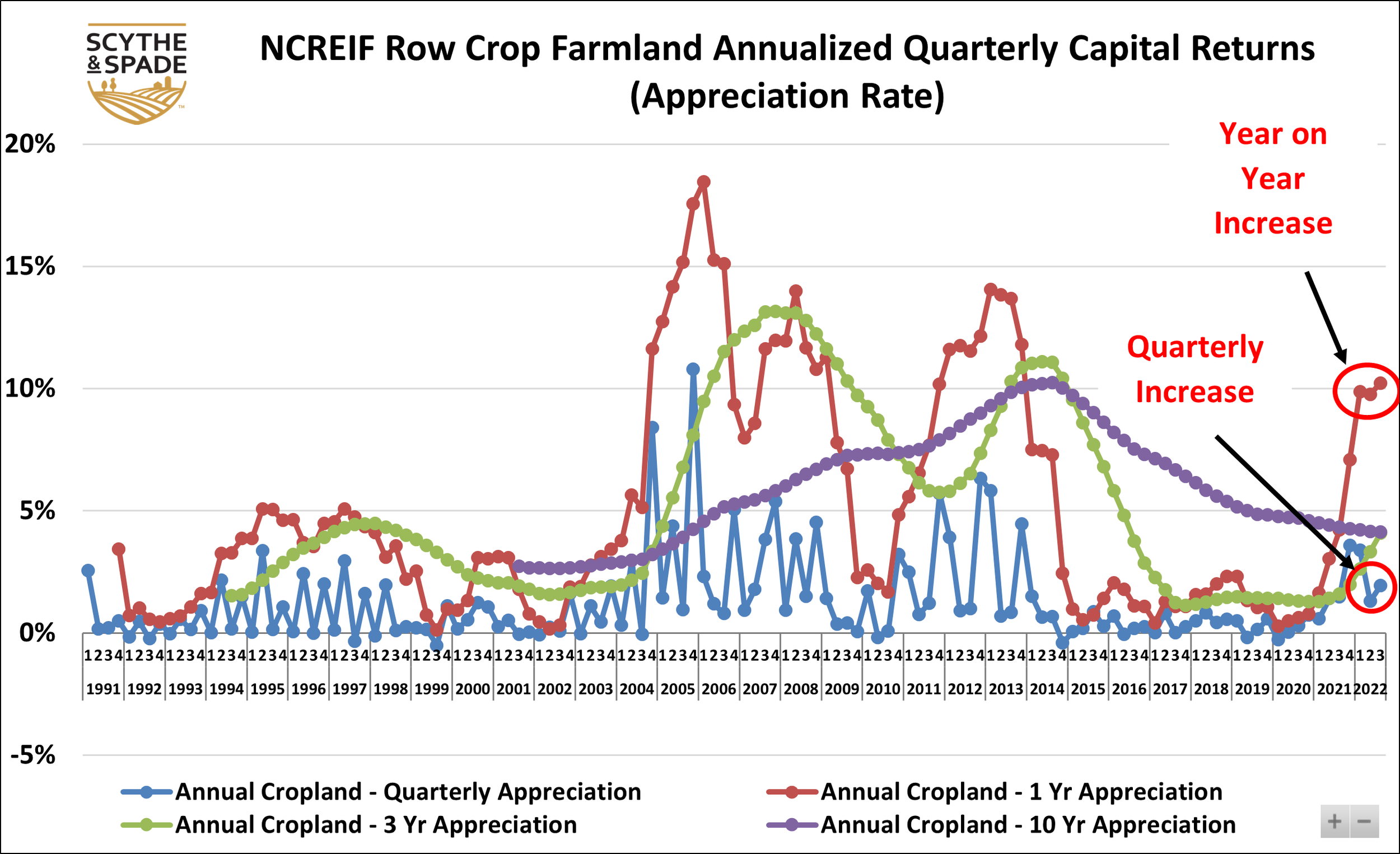

The chart below is US annualized quarterly row crop farmland value returns from NCREIF (if you aren’t familiar with NCREIF, see the description below the chart). Year on year, (red line) returns increased sharply in the last three quarters of 2021 and have held steady around 10% in the first three quarters of 2022. Note the three-year rolling average (green line) has been pulled up from the two or so percent its held steady at since 2017 and has now increased to the ten year rolling average (purple line) of 4.1%

So, have farmland prices and returns begun to retreat or have they peaked? The blue line circled in the lower right corner is the non-annualized quarter over quarter increases or decrease. Note that while the quarterly change appears to have peaked in Q4 (2021) at a 3.6% increase over the previous quarter, Q3 (2022) still saw an increase of 1.9% vs Q2. So, although the rate of increase has slowed, values were still increasing through Q3 and had not yet started trending downward.

This begs the question of how long the high farmland appreciation rates will last? When and why will they fall, and by how much? Will a slowing global economy, a super strong dollar driving decreased exports, and possibly most importantly, significantly higher interest rates correct significantly lower returns? Maybe, but this isn’t a given.

This is the first post of several we’ll be doing to explore the issues, drivers, and what we can learn from history. Stay tuned!